NPA Recovery

Non Performing Assets Recovery

Any asset which stops giving returns to its investors for a specified period of time is known as Non-Performing Asset (NPA). Financial institutions across the developing World are saddled with large Non-Performing Loans (assets) (NPAs). NPAs are an essential prudential indicator to assess the banking sector’s financial health while being synonymous with credit risk management. NPAs affect operational efficiency, which affects the profitability, liquidity and solvency of banks. NPAs generate a vicious cycle of effects on the sustainability and growth of the banking system and if not properly managed, could lead to bank failures.

Regulators across the World have been watchful of these NPAs and have brought several regulations to control and monitor them. Banks routinely fail to understand the reasons for Accounts becoming Non-Performing. Higher Interest rates results in Higher defaults.

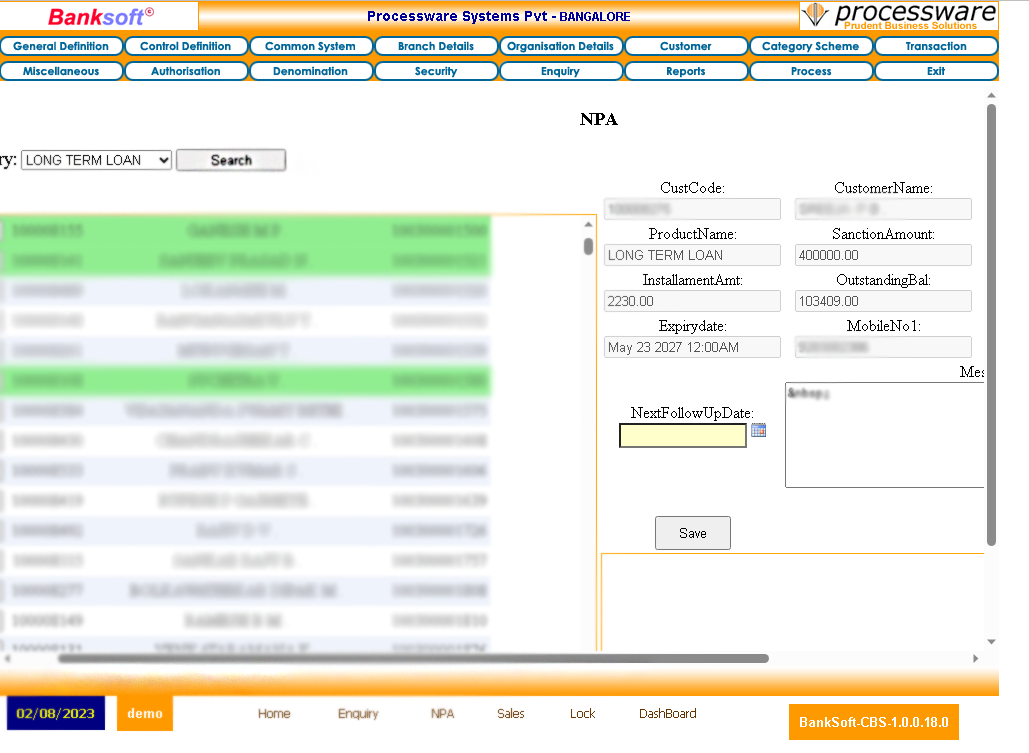

"To manage these problems in a structured format, Processware has designed and developed an AI based tool to manage NPAs in financial institutions. There are various stages to be managed to ensure effective collection from NPAs. This tool allows the user to document all the efforts done by the bank towards recovery of dues from these customers."